Hey there! If you’re like me and want your money to work harder without the daily stress of watching every market tick, dividend investing might just be your new best friend. As we kick off 2026, with the S&P 500’s average dividend yield sitting around 1.14% (a modest but steady baseline), the real magic happens when you target quality companies that pay and grow dividends reliably. Inspired by Marc Lichtenfeld’s classic Get Rich with Dividends, this guide shows you how to earn double-digit returns through a proven, low-stress system.

I’ve been investing for years, and nothing beats the feeling of cash hitting your account every quarter—especially when it grows over time. Let’s make this personal: whether you’re starting small or building for retirement, here’s how to get started today.

Why Dividend Investing Wins in 2026

Dividend stocks aren’t flashy like AI hype stocks, but they deliver. They provide real cash income plus potential price growth. Historically, dividend payers outperform non-payers with less volatility—perfect for uncertain times.

In 2026, experts highlight defensive sectors like healthcare, consumer staples, and utilities. Companies with decades of increases (Dividend Aristocrats and Kings) shine brightest. They weather storms and keep paying more each year, beating inflation easily.

This approach suits beginners: buy strong businesses, reinvest payouts, and let compounding do the heavy lifting. No day trading required!

Meet Perpetual Dividend Raisers: The Heart of the Strategy

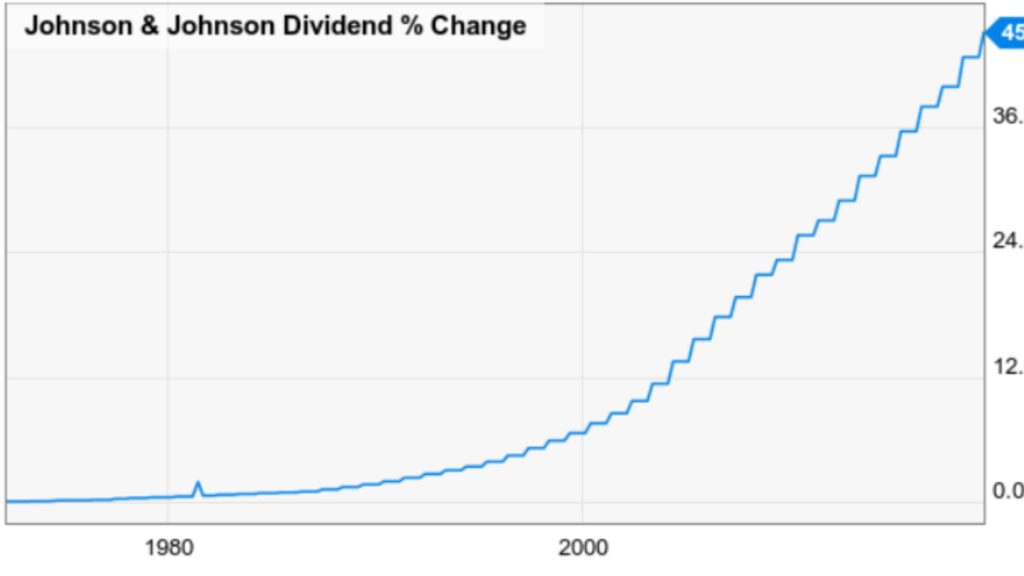

Marc Lichtenfeld calls them “perpetual dividend raisers”—companies that hike dividends year after year, often for 25+ years (Aristocrats) or 50+ (Kings). Think Procter & Gamble, Johnson & Johnson, or Coca-Cola.

Why do they matter? A starting 4% yield with 10% annual growth turns into serious income fast. Your payouts compound, growing exponentially while you sleep.

In 2026, look for Aristocrats like AbbVie, PepsiCo, or Realty Income. These firms prioritize shareholders, even in tough economies.

Key Metrics to Pick Winning Dividend Stocks

Start simple: focus on three things.

- Yield: Aim for 3-6%. Too high (10%+) often signals trouble; too low misses income.

- Payout Ratio: Under 75% of earnings (better yet, free cash flow). This leaves room for growth and safety.

- Dividend Growth Rate: 5-10%+ annually. Consistent history beats promises.

Diversify across 10-20 stocks in different sectors. Tools like Yahoo Finance or Seeking Alpha make this easy.

Top picks for beginners in 2026 include Realty Income (monthly payer, ~5-6% yield), Verizon (reliable telecom), and AbbVie (healthcare powerhouse with strong growth).

The Famous 10-11-12 System Explained

Lichtenfeld’s “10-11-12” system targets stocks yielding ~11% in 10 years with 12% average annual returns.

How? Start with ~4-5% yield + 10% growth + reinvestment + modest price appreciation. Compounding turns $10,000 into much more.

Even conservative estimates work: reinvest dividends, and watch income snowball.

The 10-11-12 system is one of the most powerful and straightforward strategies in dividend investing, popularized by Marc Lichtenfeld in his bestselling book Get Rich with Dividends: A Proven System for Earning Double-Digit Returns.

As of January 10, 2026, with markets still favoring quality income-generating stocks amid ongoing economic shifts, this time-tested approach remains highly relevant for anyone looking to build serious wealth without chasing risky hot tips.

At its core, the 10-11-12 system aims to deliver double-digit results through patient, conservative dividend investing. Specifically, it targets stocks that, after 10 years of holding and reinvesting dividends, will provide you with an 11% yield on your original investment and an average 12% annual total return (including price appreciation and reinvested dividends).

Here’s what that really means in practice: Start with a solid dividend stock today, let the company keep raising its payout every year, reinvest those dividends to buy more shares, and watch your income snowball while your portfolio grows steadily.

The Three Key Pillars of the 10-11-12 System

Lichtenfeld boils success down to three simple, interconnected criteria when selecting “Perpetual Dividend Raisers” (companies with long histories of annual dividend increases, often 25+ years):

- Starting Yield — Aim for a respectable initial dividend yield, typically around 4% to 4.7% or higher (but avoid chasing ultra-high yields above 8-10%, as they often signal trouble). A higher starting point gives you a stronger foundation to reach that 11% yield mark later.

- Dividend Growth Rate — Target companies that raise dividends by at least 10% per year on average. This growth is the engine that drives the yield higher over time without you doing anything extra.

- Payout Ratio — Keep this under 75% (ideally based on free cash flow, not just earnings). A sustainable ratio leaves plenty of room for continued raises, even during tough economic periods.

These three work together: solid yield + strong growth + safety = the math that compounds into impressive results.

How the Math Actually Works

Let’s make it real with a simple example (based on Lichtenfeld’s classic illustrations, still relevant today):

- You invest $10,000 in a stock yielding 4.7% today.

- The company raises the dividend by 10% annually.

- You reinvest all dividends to buy more shares.

After 10 years (assuming modest or even flat stock price growth), your yield on original cost hits around 11% (meaning your annual income is now ~$1,100+ on that initial $10,000). Your total portfolio value, thanks to compounding and some price appreciation, delivers an average 12% annualized return — turning your $10,000 into roughly $31,000+.

Even starting at a 4% yield with the same growth gets you very close. The difference between 4% and 4.7% might seem tiny, but compounding makes it huge over a decade.

Why It Still Works in Everytime

Markets change, but the fundamentals don’t. Perpetual Dividend Raisers (like many Dividend Aristocrats and Kings) have proven resilient through bull markets, recessions, and inflation periods. With inflation still a concern and interest rates fluctuating, reliable dividend growth helps protect and grow your purchasing power.

Lichtenfeld’s system has been battle-tested over decades, outperforming broad market averages with far less volatility. It’s not about timing the market — it’s about owning high-quality businesses that reward shareholders consistently.

Practical Tips to Get Started

- Focus on Dividend Aristocrats or Kings (companies with 25+ or 50+ years of increases).

- Use free tools like Yahoo Finance, Seeking Alpha, or Dividend.com to screen for yield, growth rate, and payout ratio.

- Diversify across 10-20 stocks in different sectors.

- Reinvest dividends automatically (via DRIPs if available) for maximum compounding.

- Hold long-term — patience is the secret sauce.

This isn’t get-rich-quick; it’s get-rich-steadily. A 12% average annual return compounds your money dramatically: triple it in 10 years, multiply it by 10 in 20 years.

FAQs

What is dividend investing for beginners? It’s buying shares in companies that pay regular cash dividends from profits, then reinvesting to grow your holdings over time.

How do I find the best dividend stocks in 2026? Focus on Dividend Aristocrats/Kings with 3-6% yields, low payout ratios, and 5-10%+ growth. Check lists on Sure Dividend or Motley Fool.

What are the main risks? Dividend cuts during downturns, company issues, or inflation outpacing growth. Diversify and choose stable firms.

Should I reinvest dividends? Yes for long-term growth—compounding accelerates wealth. Collect cash if you need income now.

Are high-yield dividends safe? Not always—ultra-high yields can signal problems. Stick to quality companies with sustainable payouts.

How do taxes work on dividends? Qualified ones are taxed at 0-20%. Retirement accounts defer taxes for maximum growth.

Start today—your future self will thank you! 🚀