Trading is often about simplifying decisions, not adding complexity. Among the many price action tools available, the inside bar trading strategy stands out for its clarity, flexibility, and effectiveness across markets. It highlights moments of consolidation where volatility contracts and prepares traders for potential expansion.

This guide breaks down the inside bar pattern in a clear, practical way, helping you understand when it works, when it fails, and how to trade it with discipline. Whether you focus on stocks, forex, indices, or commodities, this strategy can become a reliable part of your trading toolkit.

What Is an Inside Bar Pattern?

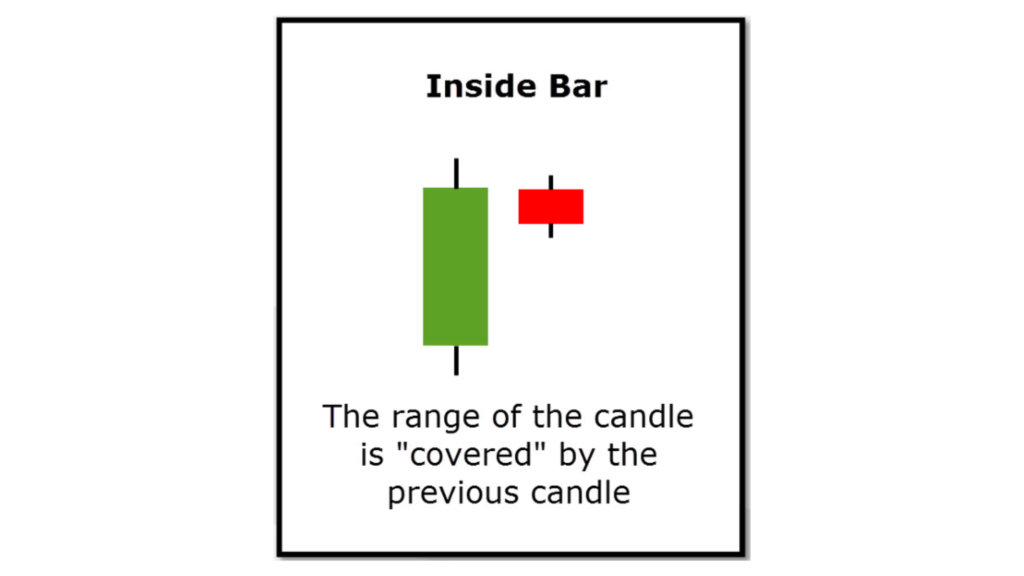

An inside bar is a two-candlestick formation where the second candle’s high and low are fully contained within the range of the previous candle, often called the mother bar.

In simple terms:

- The market pauses after a strong move.

- Buyers and sellers reach temporary balance.

- Volatility contracts before the next directional move.

This contraction often leads to expansion, making inside bars valuable for low-risk, high–reward trade setups when used in the right context.

Why the Inside Bar Strategy Works

Markets move in cycles of expansion and contraction. Inside bars visually represent contraction. When price eventually breaks out of that tight range, momentum often follows.

Key reasons traders use inside bar trading strategy:

- Clear structure with defined risk

- Works well with trend-following strategies

- Minimal indicators required

- Adaptable across timeframes and asset classes

Studies on price action behavior consistently show that continuation patterns perform best when aligned with the dominant trend, which is exactly where inside bars shine.

For further reading on price action concepts, you can refer to:

- Investopedia – Candlestick Patterns: https://www.investopedia.com/trading/candlestick-charting-what-is-it/

- CME Group – Understanding Market Volatility: https://www.cmegroup.com/education/articles-and-reports/understanding-volatility.html

Common Inside Bar Trading Mistakes to Avoid

1. Trading Every Inside Bar

Not all inside bars are tradeable. Inside bars that form in sideways or low-momentum markets often result in false breakouts. Context matters more than the pattern itself.

2. Ignoring the Trend

inside bar trading strategy work best with the trend, not against it. Trading countertrend inside bar trading strategy significantly lowers probability and increases drawdowns.

3. Poor Timing and Liquidity

Breakouts during low-volume sessions are more likely to fail. Focus on periods where participation is high and volatility can expand smoothly.

Inside Bar Strategy #1: Trading with the Trend

This is the most reliable application of the inside bar trading strategy pattern.

Setup conditions:

- Clear uptrend or downtrend

- Price holding above or below a short-term moving average

- Inside bar trading strategy forms after a strong impulsive move

Execution:

- Enter on the break of the inside bar in the trend direction

- Place stop loss beyond the opposite side of the inside bar

- Target at least a 1:2 risk–reward ratio

Trending markets provide momentum, making continuation inside bars statistically favorable.

Inside Bar Strategy #2: Post-Breakout Continuation

After price breaks out of a range or key level, it often pauses before continuing.

How to trade it:

- Identify a clean breakout from consolidation.

- Wait for the first inside bar after the breakout.

- Enter on the breakout of that inside bar in the same direction.

This approach filters false breakouts and allows traders to enter after confirmation, not during emotional spikes.

For deeper insights into breakouts:

- Nasdaq – How Breakouts Work: https://www.nasdaq.com/articles/how-to-trade-breakouts

- BabyPips – Breakout Trading Basics: https://www.babypips.com/learn/forex/breakout-trading

Inside Bar Strategy #3: Multi-Timeframe Swing Trading

Inside bar trading strategy become even more powerful when combined with higher timeframe analysis.

Process:

- Identify support or resistance on a higher timeframe

- Drop to a lower timeframe

- Trade the inside bar that aligns with the higher timeframe bias

This method offers:

- Smaller stop losses

- Higher reward potential

- Better trade clarity

Multi-timeframe alignment is a core principle in professional trading systems.

Entry, Stop Loss, and Exit Techniques

Entry Options

- Inside bar break: Tighter stop, faster feedback

- Mother bar break: Higher momentum, wider stop

Stop Loss Placement

- Just beyond the inside bar high/low for aggressive entries

- Add volatility buffer (ATR-based) for swing trades

Exit Strategies

- Fixed risk–reward targets (1:2 or higher)

- Trailing stops using moving averages

- Partial profit booking at key levels

According to risk management principles outlined by the CFA Institute, consistency in exits is as important as entries:

Who Should Use the Inside Bar Strategy?

inside bar trading strategy is well suited for:

- Traders who prefer clean charts

- Those balancing trading with other commitments

- Swing traders and trend followers

- Beginners learning price action foundations

Higher timeframes tend to produce fewer but higher-quality inside bar setups, making them ideal for disciplined traders.

Final Thoughts: Making inside bar trading strategy Part of Your Edge

The inside bar trading strategy is not about predicting the market. It’s about responding to price behavior with structure and discipline. When combined with trend direction, proper timing, and risk management, inside bars can offer consistent opportunities with controlled downside.

Start by focusing on quality over quantity. Track your trades, review performance, and refine rules. Over time, this simple pattern can become a dependable ally in navigating uncertain markets.

Frequently Asked Questions

What does an inside bar indicate?

Market consolidation and potential volatility expansion.

Is the inside bar a reversal or continuation pattern?

It can be both, but performs best as a continuation setup in trending markets.

Does it work on all timeframes?

Yes, though higher timeframes typically offer better reliability.

Can it be used without indicators?

Absolutely. It is a pure price action strategy.

What win rate can be expected?

When traded with trend and context, many traders report win rates between 50–60%, with favorable risk–reward ratios.