Hey there, fellow trader! If you’re just dipping your toes into the world of trading or you’ve been struggling to make consistent profits, you’re in the right place. I remember when I first started – I was that guy glued to my screen, overloaded with fancy indicators and news feeds, thinking they held the key to riches. Spoiler: they didn’t. What turned things around for me was discovering Price Action Trading Strategies for Beginners. It’s like learning to read the market’s language directly from the charts, without all the noise. In this guide, I’ll share practical strategies I’ve used to go from confused beginner to managing a solid portfolio. We’ll cover everything from basics to advanced tips, all in simple terms. Let’s dive in and build your trading skills step by step.

Introduction to My Trading Journey

When I was in my early 20s, I got hooked on investing after reading about successful stock pickers. I dove into books on value investing and fundamentals, thinking I had it all figured out. I checked balance sheets, revenue growth, and all that jazz. My first trade? Bought a stock during a market recovery, planning to hold until it doubled. Guess what? Emotions kicked in, and I sold at a loss just days later. Sound familiar?

Then I tried forex, following online gurus with indicators like Bollinger Bands. Wins at first, then losses wiped me out. I chased complex patterns, but the cycle repeated. It took years to realize the problem wasn’t the strategies – it was ignoring the natural laws of trading and not understanding the concept Price Action Trading Strategies for Beginners. Today, I trade forex, stocks, and ETFs profitably, and I run a blog helping thousands. Price action changed everything for me, and it can for you too. It’s about reading the raw story the market tells through its price movements. According to Investopedia, price action is the movement of a security’s price plotted over time, forming the basis for technical analysis. For more on basics, check out this guide from PriceAction.com.

In this blog, I’ll share strategies to trade without fundamentals or signals, time entries better, trade with the path of least resistance, spot opportunities across markets, manage risk like a pro, and even advanced techniques. Let’s get started – and remember, always verify what you learn, as no one else will do the work for you.

The Natural Laws of Trading You Need to Know

Trading isn’t just about charts; it’s governed by unspoken rules that many ignore at their peril. I learned this the hard way after blowing accounts. One key law is that markets move in cycles – up, down, sideways – and fighting them leads to losses. Another is that risk is inevitable, but controlling it is what separates winners from losers.

Markets aren’t random; they’re driven by supply and demand imbalances. When buyers dominate, prices rise; when sellers do, they fall. But emotions play a role too – greed pushes prices too high, fear too low. Understanding these laws means accepting that you can’t win every trade, but you can tilt odds in your favor by trading with the trend or in ranges. For instance, in volatile markets, expect reversals after big moves. As explained on LearnToTradeTheMarket, price action reflects all market variables, making it essential for spotting these imbalances. Check out Babypips’ forex lessons for more on market cycles.

Personally, embracing these laws turned my trading around. I stopped forcing trades and let the market come to me. You should too – it reduces stress and boosts consistency.

The Truth About Support and Resistance Levels

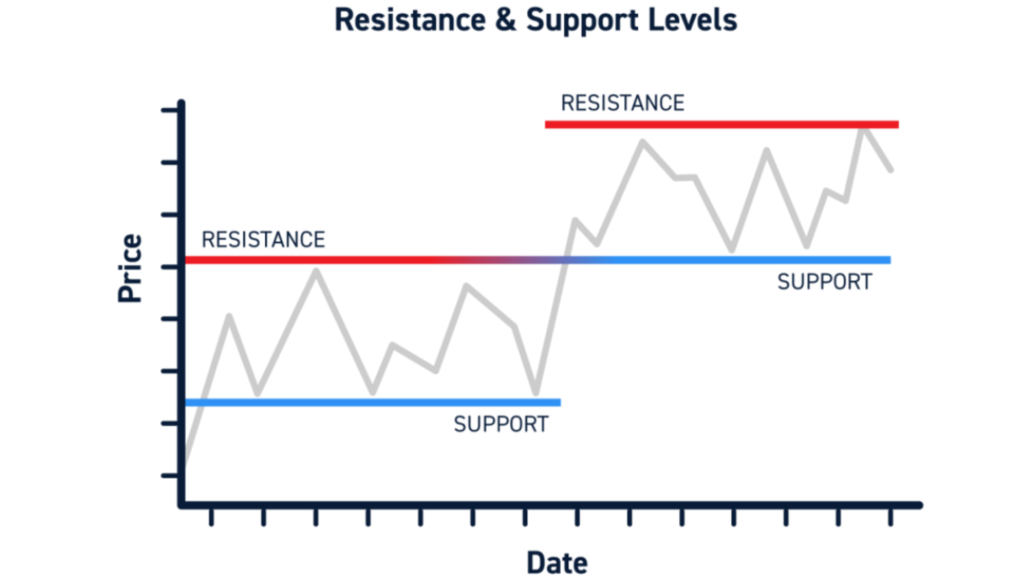

Support is where buying pressure stops falls; resistance where selling stops rises. But they’re not lines – they’re areas. I learned to draw them by zooming out to 300 candles, focusing on obvious levels, and adjusting for max touches.

Truth? The more tests in a short time, the weaker they become as orders get filled. Also, broken support can become resistance. Use them as value areas to buy low, sell high. Investopedia defines support as areas of buying pressure. Explore CenterPoint Securities guide.

In my trades, treating them as areas saved me from false breaks.

Mastering Candlestick Patterns Like a Pro

Candlesticks show open, high, low, close – the market’s pulse. I don’t memorize hundreds; I read what they say about control.

Bullish reversals like hammer (rejection of lows), engulfing (buyers overwhelm sellers). Bearish like shooting star. Key: ask “Who’s in control?” and “Is there strength?”

They became my entry triggers after I focused on context, not isolation.

The Secret to Effective Risk and Trade Management

Risk management is your lifeline. I lost accounts ignoring it. Set stops at invalidation points, like below support, with buffer (1 ATR).

Position size: risk 1% per trade. For forex, position = risk / (stop pips * pip value). For stocks, shares = risk / stop dollars. Investopedia on risk techniques.

Exits: capture swings before opposition or trail for trends. Hybrid for uncertainty. This kept me in the game.

Developing Winning Trading Strategies to Beat the Markets

Use formulas like MAEE (structure, value, trigger, exits) for reversals, MBEE for breakouts, DERR for consistency.

For MAEE, spot structure, value area, trigger like candle rejection, exits with stops/profits. Tweak to fit. Forex.com on price action strategies.

DERR: plan, execute, record, review. It made me profitable by fixing mistakes.

Advanced Price Action Techniques No One Talks About

Pre-breakout: enter on lower timeframe rejection in buildup. Axi on breakout strategies.

Classify trends: strong (shallow pullbacks), healthy (to 50MA), weak (deep). Avoid overextended trades.

Hidden strength: larger retracements signal weakness. Exhaustion via ATR. Markets differ in trending/mean-reverting. Higher timeframe for management. Volatility cycles for entries.

Real Trading Examples to Learn From

NZDJPY breakout: accumulation, buildup at resistance, buy above highs, trail with ATR.

EURNZD breakout: range, buildup at resistance, sell below lows.

EURCAD reversal: downtrend, engulfing at resistance, short, targets at lows.

WTI reversal: range, power move to support, long on rejection.

GBPUSD reversal: downtrend, hammer at low, long, trail lows.

Stay out examples: USDINR mid-range, poor R:R; S&P overextended; T-Bond no structure; Gold post-breakout no value.

Tradeciety on reversal strategies.

Final Thoughts and Motivation

Trading transformed my life, from losses to consistency. Remember, your past doesn’t define your future – find your why, like I did for family. Persevere; the how follows.

For more, grab bonus resources at priceactiontradingsecrets.com/bonus.

Good luck!

FAQs

What is price action trading for beginners?

It’s analyzing charts without indicators to spot buy/sell signals based on price movements.

How do I start price action trading?

Clean your charts, learn structure, levels, candles, practice on demo.

Is price action trading profitable?

Yes, with discipline and risk management.

What are the best price action patterns?

Hammer, engulfing, doji for reversals; breakouts for trends.

How to manage risk in price action trading?

Risk 1% per trade, use stops at invalidation points.

Can I trade price action without indicators?

Absolutely, it’s the core idea.

What’s the difference between breakout and reversal?

Breakout rides momentum; reversal catches turns.

How to identify market structure?

Look for highs/lows: higher for uptrends, lower for down.

Why avoid overextended trends?

Poor R:R, likely pullbacks.

How many trades to review for improvement?

At least 100 for expectancy.