Bear markets test even the most experienced traders, but they also present unique opportunities for those prepared with the right knowledge and tactics. A bear market is generally defined as a sustained decline of 20% or more from recent highs in major indices like the S&P 500 or equivalent benchmarks. These periods often coincide with economic uncertainty, reduced investor confidence, and widespread selling pressure.

This guide on Bear Market Trading Strategies explains how traders can adapt during market downturns focusing on capital preservation, risk management, and tactical opportunities that emerge when fear dominates the market. Instead of reacting emotionally, learn how disciplined traders position themselves to survive bearish phases and profit when conditions stabilize.

While bear markets can feel overwhelming, they are a normal part of market cycles. Historical data shows they occur periodically, with average durations around 9-10 months, though some last longer. The key is not to avoid them entirely impossible to predict perfectly but to recognize signs early, protect capital, and position for potential gains or recoveries.

This guide breaks down practical strategies based on proven principles, explained in simple terms. Whether trading stocks, indices, or other assets, focus on risk management first: never risk more than 1-2% of your capital on any single trade.

Understanding Bear Markets: Phases and Causes

Bear markets unfold in distinct phases. The first involves high prices and optimism fading as investors take profits. The second sees sharp drops, falling corporate profits, and rising fear. Panic or capitulation often marks the intense selling near bottoms, followed by eventual recovery.

Common triggers include recessions, high inflation, geopolitical events, or bursting asset bubbles. Investor sentiment shifts from greed to fear, amplifying declines through forced selling (e.g., margin calls).

Bear markets differ from corrections (10-20% drops) in depth and duration. They force reevaluation of portfolios and highlight the importance of diversification and hedging.

How to Spot a Bear Market on the Horizon: Key Warning Signs

Early detection allows time to adjust positions defensively. No indicator is infallible, but combinations strengthen signals.

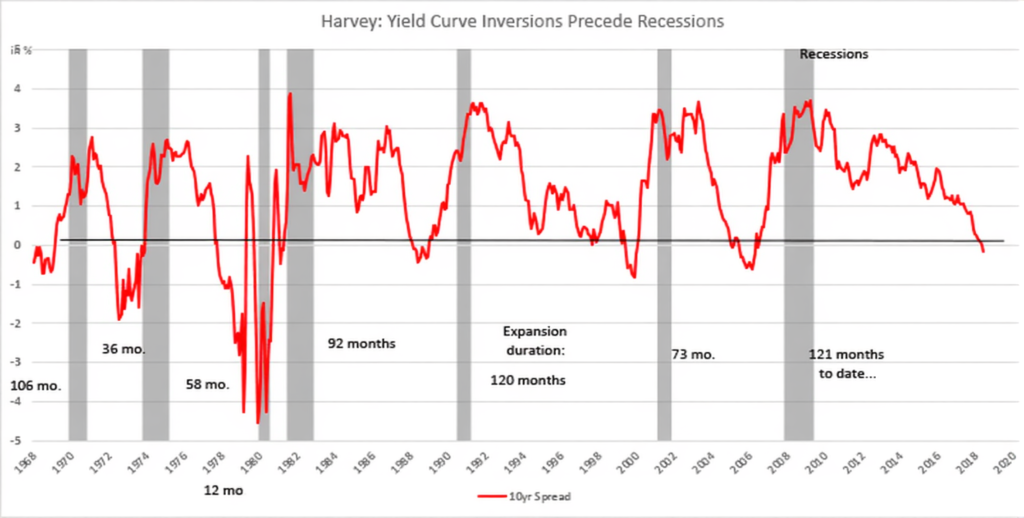

Inverted Yield Curve — When short-term bond yields exceed long-term ones, it often signals economic slowdown ahead. This has preceded many recessions reliably.

Declining Market Breadth — If fewer stocks drive gains (e.g., advance-decline line weakens), broad participation fades—a classic red flag.

Technical Breakdowns — Death crosses (50-day moving average below 200-day), breakdowns below support levels, or momentum divergences (e.g., RSI showing weakness).

Sentiment Extremes — High valuations (elevated P/E ratios), euphoria in speculative areas, or fear/greed index extremes.

Economic Weakness — Rising unemployment, slowing GDP, or poor consumer data.

Track these via platforms like TradingView. Clusters of signals increase conviction—act gradually rather than all at once.

Effective Bear Market Trading Strategies That Work

Shift focus to preservation and selective opportunism. Here are reliable approaches:

Short Selling — Sell borrowed shares high, buy back lower. Target overvalued or momentum stocks breaking down. Use tight stops to cap losses from squeezes.

Put Options — Buy puts for leveraged downside bets or protective hedges on holdings. Bear spreads limit risk while capturing moderate declines.

Inverse ETFs — Funds like those tracking inverse S&P 500 rise when markets fall. Simple, no margin needed—ideal for broad exposure.

Defensive Rotation — Shift to bonds, gold, utilities, or consumer staples that hold value better amid fear.

Portfolio Hedging — Offset long positions with inverse tools or puts to reduce overall downside.

Always emphasize stops, position sizing, and avoiding over-leverage. Volatility rises in bears, so adaptability matters.

An Automated Trading Approach for Bear Market Trading

Remove emotion with rules-based systems. Build or use automation that:

Triggers shorts on breakdowns (e.g., price below key moving averages + volume spikes).

Filters for high volatility or overbought conditions in declines.

Enforces strict stops and position limits.

Platforms support scripting for backtesting against historical bears. Test rigorously—automation shines in consistent edges but can falter in whipsaws.

Recognizing When a Bear Market Is Nearing Its End

Timing reversals helps exit shorts or enter longs. Watch for:

Capitulation — Extreme volume spikes and panic selling signal exhaustion.

Reversal Patterns — Higher lows, bullish divergences, or golden crosses.

Breadth Thrust — Surge in advancing stocks over few days.

Economic Turnarounds — Improving data or policy support.

Recoveries often accelerate—early participation captures strong moves.

Shorting Momentum Stocks Effectively in Declines

High-flyers crash hardest. Identify overextended names (high RSI, stretched valuations), wait for support breaks with volume, enter shorts, and place stops above highs. Size small to manage squeeze risk.

Stocks and Assets to Consider Buying When Others Sell

Contrarian opportunities emerge:

Strong-balance-sheet blue-chips with dividends.

Undervalued sectors post-panic.

Safe havens like Treasuries or commodities.

Focus on fundamentals—buy when fear disconnects prices from value. Dollar-cost average into dips for longer horizons.

Bear markets challenge discipline but reward preparation. Spot signs, deploy smart tactics, automate where helpful, and recognize bottoms. Markets cycle—downturns set up future advances. Practice in demos, manage risk rigorously, and stay informed.

FAQs

What defines a bear market?

A sustained 20%+ decline from peaks in major indices, driven by fear, economic weakness, or shocks lasting months to years on average.

Are bear markets predictable?

Not perfectly, but signals like inverted yield curves, weak breadth, and sentiment extremes offer strong clues when clustered.

Is short selling suitable for beginners?

It’s advanced with unlimited loss risk—start with inverse ETFs or simulated trades.

How can I protect my portfolio without selling everything?

Hedge with puts, inverse ETFs, or shift to defensives like bonds/gold.

What signals a bear market bottom?

Capitulation (panic selling), breadth thrusts, reversals, and economic improvements.

Should trading stop during bear markets?

No—opportunities in shorts, options, or contrarian buys exist, but prioritize capital preservation.